Renters Insurance in and around Kalamazoo

Looking for renters insurance in Kalamazoo?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Think about all the stuff you own, from your couch to smartphone to sports equipment to bedding. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Kalamazoo?

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps safeguard your personal possessions in case of the unexpected.

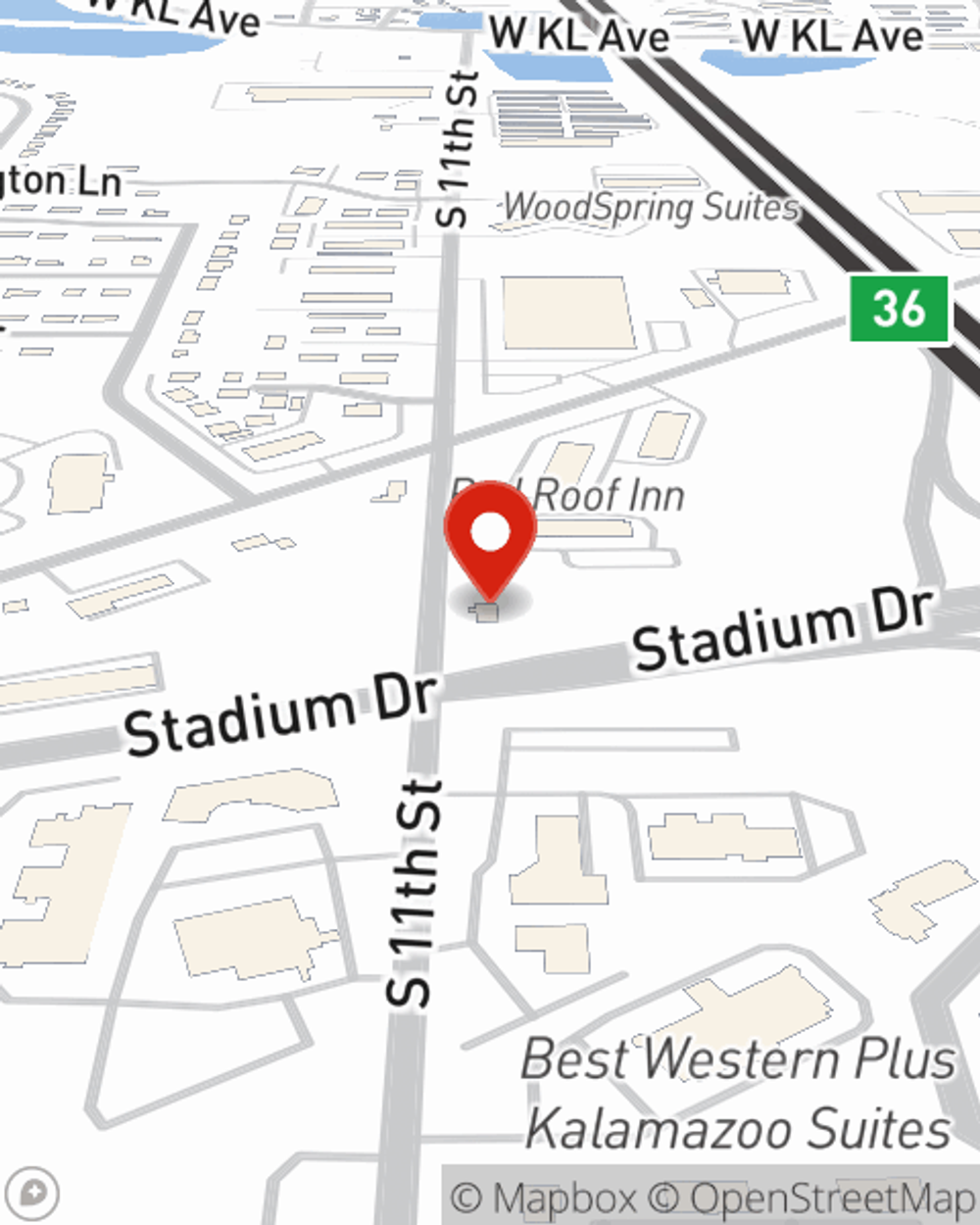

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Kalamazoo. Reach out to agent Mike May's office to see about a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Mike at (269) 544-2448 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.